puerto rico tax incentives code

Promotes the environment opportunities and adequate tools to foster the. 60-2019 hereinafter the Incentives Code.

Puerto Rico Has A New Tax Incentives Code

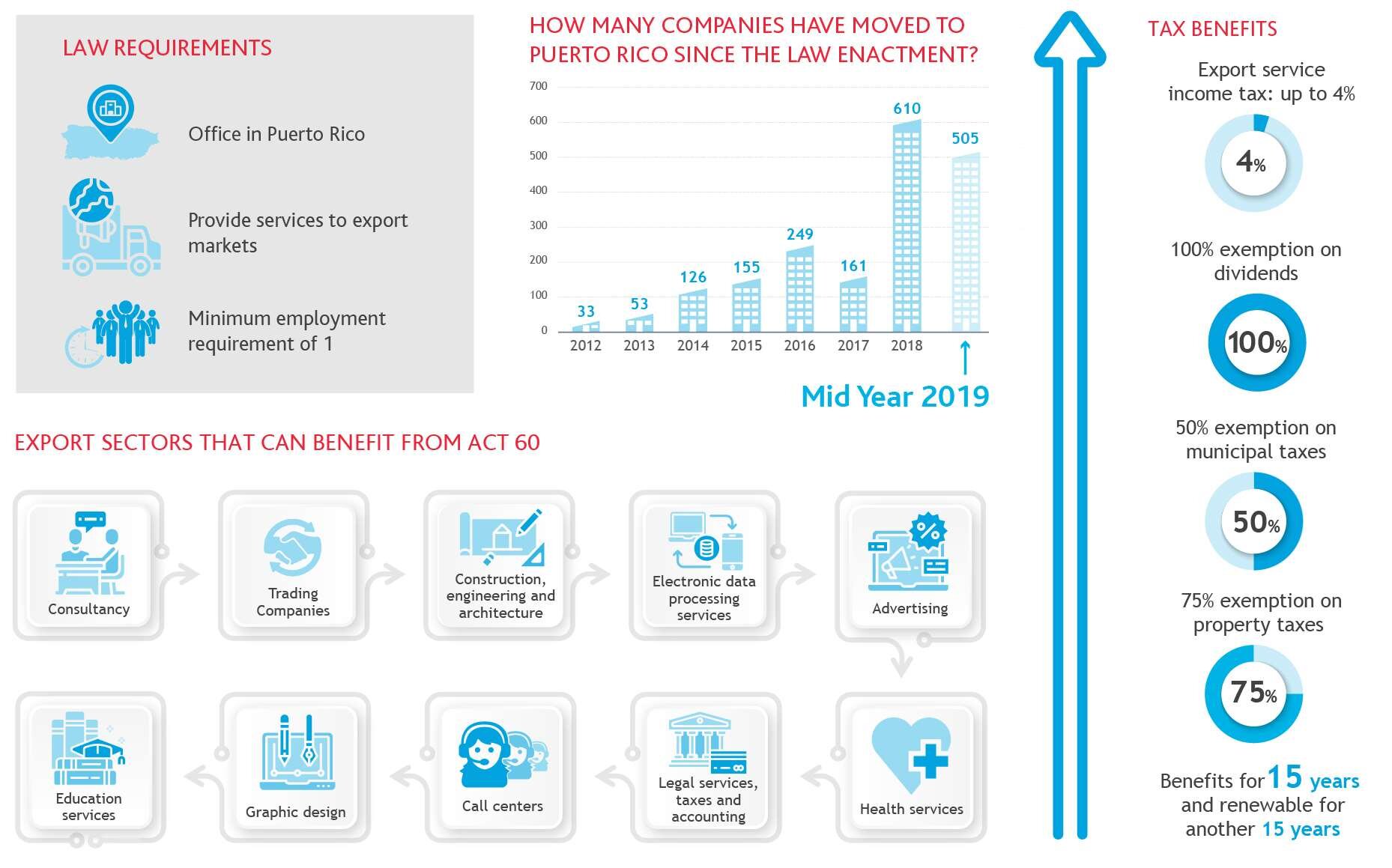

Through this regulation provisions for Act 60 of 2019 known as the Puerto Rico Incentives Code went into effect with the purpose of establishing the norms requirements and criteria to be used in the application and awarding of the benefits granted under this law.

. 60 known as the Puerto Rico Incentives Code which consolidates the dozens of decrees incentives subsidies reimbursements or tax or financial benefits existing at the date of its approval. Puerto Rico Tax Incentives. If youre looking for a strong return on your investment you need to understand the details of Act 20 and Act 22 Puerto Rico tax incentives for business and individual investorsIn a recent attempt to strengthen its economy and attract investors the local government has stepped up its economic and tax incentives for those wanting to do business here.

100 exemption on dividend taxes. In order to bolster a diversified economy the local government has. Corporate - Tax credits and incentives.

Many high-net worth Taxpayers are understandably upset about the massive US. SAN JUAN PR November 8 2019 Governor of Puerto Rico Ricardo Rosselló signed Act 602019 commonly known as the Puerto Rico Incentives Code into law on July 1 2019 with an effective date of January 1 2020The Incentives Code consolidates various tax decrees incentives subsidies. 100 exemption from municipal license taxes and other municipal taxes.

With an ever-growing array of services and emerging industries part of your success will be directly attributable to the incentives available. Learn More LEARN MORE ABOUT THE BENEFITS OF ACT 60 AND ITS INCENTIVE PROGRAMS. Other tax credits and incentives.

21 of 14 May 2019 also known as the Development of Opportunity Zones of Economic Development Act of. The new regulation for Puerto Rico Incentives Code 9248 became effective on January 20th 2021. Sometimes effective tax planning can help avoid these taxes.

The Act codifies incentives granted for diverse purposes throughout decades with the aim to foster economic development more effectively. 21 of May 14 2019 also known as the Development of Opportunity Zones of Economic Development Act of Puerto. This Code is approved with the conviction that it shall improve Puerto Ricos economic competitiveness.

The purpose of the bill was to consolidate all tax and monetary benefits conferred through separate statutes into a single code and eliminate tax incentives that were. Fixed income tax rate on eligible income. New Puerto Rico Tax Incentives Code Act 60 Explained 20 22 In addition to attract investment Puerto Rico enacted two tax acts Act 20 and Act 22.

Also adds a section on the exempt nature of distributions from TDIs EP. Taxes levied on their employment investment and corporate income. 90 exemption from municipal and state taxes on property.

The remaining 10 is subject to the applicable tax rates under the Puerto Rico Internal Revenue Code as amended the PRIRC. The purpose of Puerto Rico Incentives Code 60 is to promote investment in Puerto Rico by providing investment residents with tax breaks. Puerto Rico Incentives Code Act 602019 Signed into Law.

The Incentives Code eliminates the 90 exemption and instead establishes a flat 4 tax rate on TDI. The Governor of Puerto Rico on 1 July 2019 signed into law House Bill 1635 into Act 60-2019 known as the Incentives Code of Puerto Rico the Incentives Code. Thousands of Americans have already moved to the US-owned.

1635 known as the Incentive Code of Puerto Rico and enrolled as Act No. Tax on Capital Gains Dividends Interest Crypto Gains1 Up to 50. Under the Puerto Rico Energy Public Policy Act PREPA must obtain 40 of its electricity from renewable resources by 2025 60 by 2040 and 100 by 2050.

The Act adopts a legal and administrative framework for the application. The tax incentives available in Act 60 can only be applied towards one 1 new business per young individual and the new business. Back in tradeable tax credits on RD expenditures.

On July 1st 2019 the Governor of Puerto Rico signed into law House Bill No. Back in tradeable tax credits on RD expenditures. Known as the Puerto Rico Incentive Code to.

Feature films short films documentaries television programs series in episodes mini-series music videos national and international. 1 day agoLowering marginal tax rates reduces the incentive to engage in this kind of behavior and if complemented with an expanded tax base could lead to higher tax collections. A new business is not a business that has been operating through affiliates or that is created after a business reorganization as defined in the Puerto Rico Internal Revenue Code of 2011 as amended the Code.

Puerto Rico is far too reliant on tax incentives as a tool for incentivizing development and the magnitude of incentives offered through the tax code is introducing heavy distortions and nonuniformity into the tax system and significantly contributes to the development of an unfriendly underlying tax regime. It offers the following main tax benefits. Few places on earth offer a return on investment the way Puerto Rico does.

Fixed income tax on eligible income. The Puerto Rico Incentives Code Act 60 helps build a vibrant community by promoting economic growth through investment innovation and job creation. A simpler tax code if drafted correctly would generate lower enforcement and compliance costs and higher tax collections.

On July 1 2019 the Governor of Puerto Rico signed into law Act 60 also known as the Puerto Rico Tax Incentives Code Incentives Code which consolidated dozens of tax decrees incentives subsidies and tax benefits in a single statute including Act No. Last reviewed - 21 February 2022. On July 1 2019 the Governor of Puerto Rico converted House Bill 1635 into Act 60-2019 known as the Incentives Code of Puerto Rico the Act.

Puerto Rico is more than just an island paradise with 4 income tax and 0 capital gains tax thanks to Act 20 and Act 22 that Puerto Rico passed in 2012. Puerto Rico Act 60 Incentives Code Puerto Rico Act 60 Incentives Code Tax Implications. The Incentives Code consolidates incentives granted for diverse purposes throughout decades like manufacturing activities and.

On 1 July 2019 the Governor of Puerto Rico signed into law Act 60 also known as the Puerto Rico Tax Incentives Code Incentives Code which consolidated dozens of tax decrees incentives subsidies and tax benefits in a single statute including Act No. Puerto Ricos Incentives Code. As provided by Puerto Rico Incentives Code 60.

Act 20 Act 22 Act 27 Act 73 Act 273.

Best Commercial Industrial Real Estate Listing Company In Puerto Rico

Tax Benefits Puerto Rico S Strategic Location Status As A Us Jurisdiction And Generous Tax Incentives Make It An Ideal Base For Entities That Provide Ppt Download

More Biotechs Attracted To Puerto Rico Bioprocess Insiderbioprocess International

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

A Red Card For Puerto Rico Tax Incentives Washington Dc Tax Law Attorney Montgomery County Irs Audit Lawyer

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

Puerto Rico Incentives Code Tax Alert Rsm Puerto Rico

Discover Act 60 And Its Tax Incentives For Moving Your Business To Puerto Rico Approved Freight Forwarders

A Detailed Analysis Of Puerto Rico S Tax Incentive Programs Premier Offshore Company Services

New Puerto Rico Tax Incentives Code Act 60 Explained 20 22

Puerto Rico Tax Incentives Defending Act 60 Youtube

Puerto Rico S Challenges Present An Opportunity For Tax Reform Foundation National Taxpayers Union

Puerto Rico Tax Incentives Fee Increases Relocate To Puerto Rico With Act 60 20 22

Puerto Rico Tax Incentives The Ultimate Guide To Act 20 And Act 22

Puerto Rico Taxes How To Benefit From Incredible Tax Incentives Global Expat Advisors

Telemedicine And Export Incentives In Times Of Covid 19 Grant Thornton